rhode island state tax form 2021

We last updated Rhode Island Form RI-1040 Instructions in January 2022 from the Rhode Island Division of Taxation. Refund for Appraisals Bills Mileage and Leased Vehicles C-REF-SU PDF file less than.

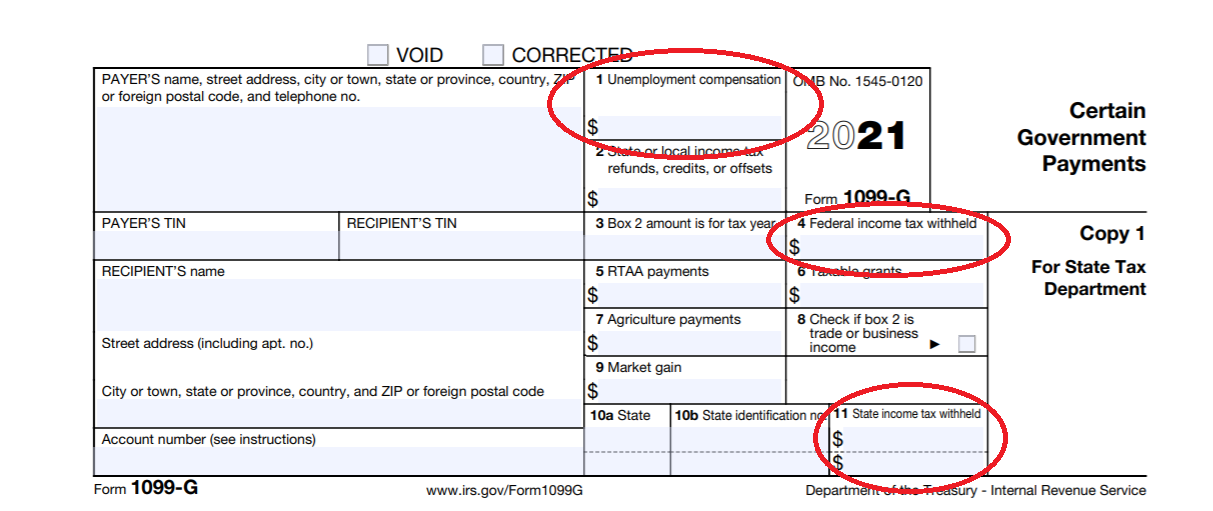

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

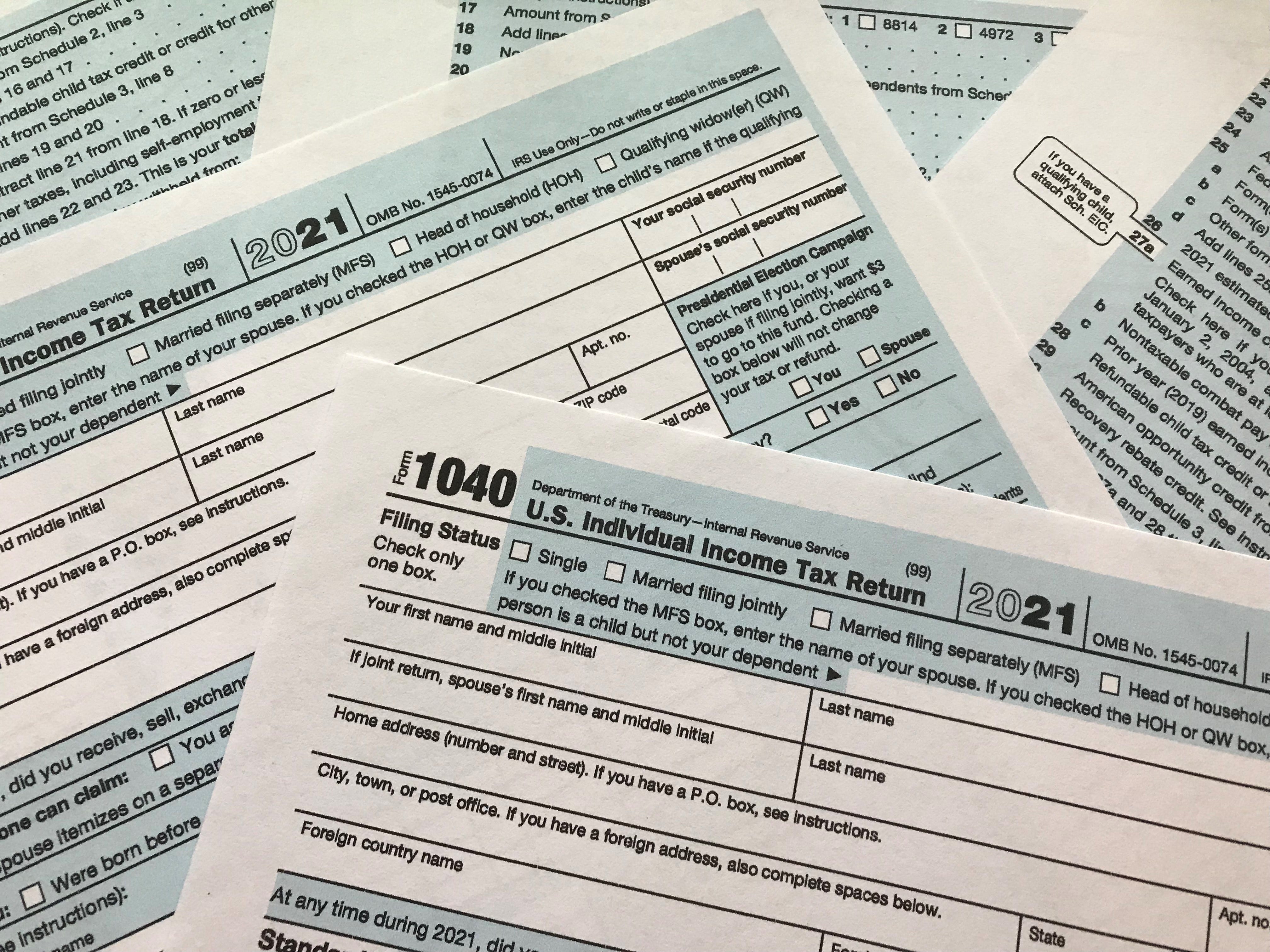

More about the Rhode Island Form 1040 Individual Income Tax Tax Return TY 2021.

. This form is for income earned in tax year 2021 with tax returns due in. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum. We last updated Rhode Island Form 1040NR in January 2022 from the Rhode Island Division of Taxation.

Along with the above requirements a taxpayer must be domiciled in the state of Rhode Island as per their 2021 RI-1040 or RI-1040NR to be eligible. Form 1040H - Property Tax Relief Claim. RI-1040 - Rhode Island Resident Individual Income Tax Return 2021 FileIT RI-1040H - Rhode Island Property Tax Relief Claim 2021 FileIT RI-1040MU - Credit for Income Taxes Paid to.

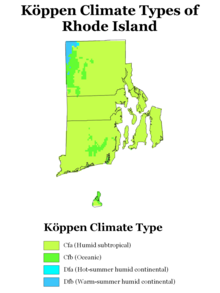

2021 Rhode Island Printable Income Tax Forms 79 PDFS Rhode Island has a state income tax that ranges between 3750 and 5990. Printable Rhode Island state tax forms for the 2021. This form is for income.

More about the Rhode Island Form 1040NR Nonresident. We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode. If you are a legal resident of Rhode Island that lives in a household or rents property that is subject to tax in the state and are up to date on all.

TX-16-22 PDF file less than 1mb. Form RI-1040 is the general income tax return for Rhode Island residents. Affidavit of Gift of Motor Vehicle SU 87-65 PDF file less than 1mb.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Claim for Refund of Temporary Disability Insurance Tax with Instructions. RI-1040 can be eFiled or a.

More about the Rhode Island Form 1040MU Individual Income Tax Tax Credit TY 2021 We last updated the Credit for Taxes Paid to Other State multiple in January 2022 so this is the latest. TaxFormFinder provides printable PDF. Rhode Island has a state income tax that ranges between 375 and 599 which is administered by the Rhode Island Division of Taxation.

The 2022 Child Tax Rebate will be an. Rhode Island state income tax Form RI-1040 must be postmarked by April 18 2022 in order to avoid penalties and late fees. Rhode Island State Income Taxes for Tax Year 2021 January 1 - Dec.

31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Tax Documents Office Of The Controller

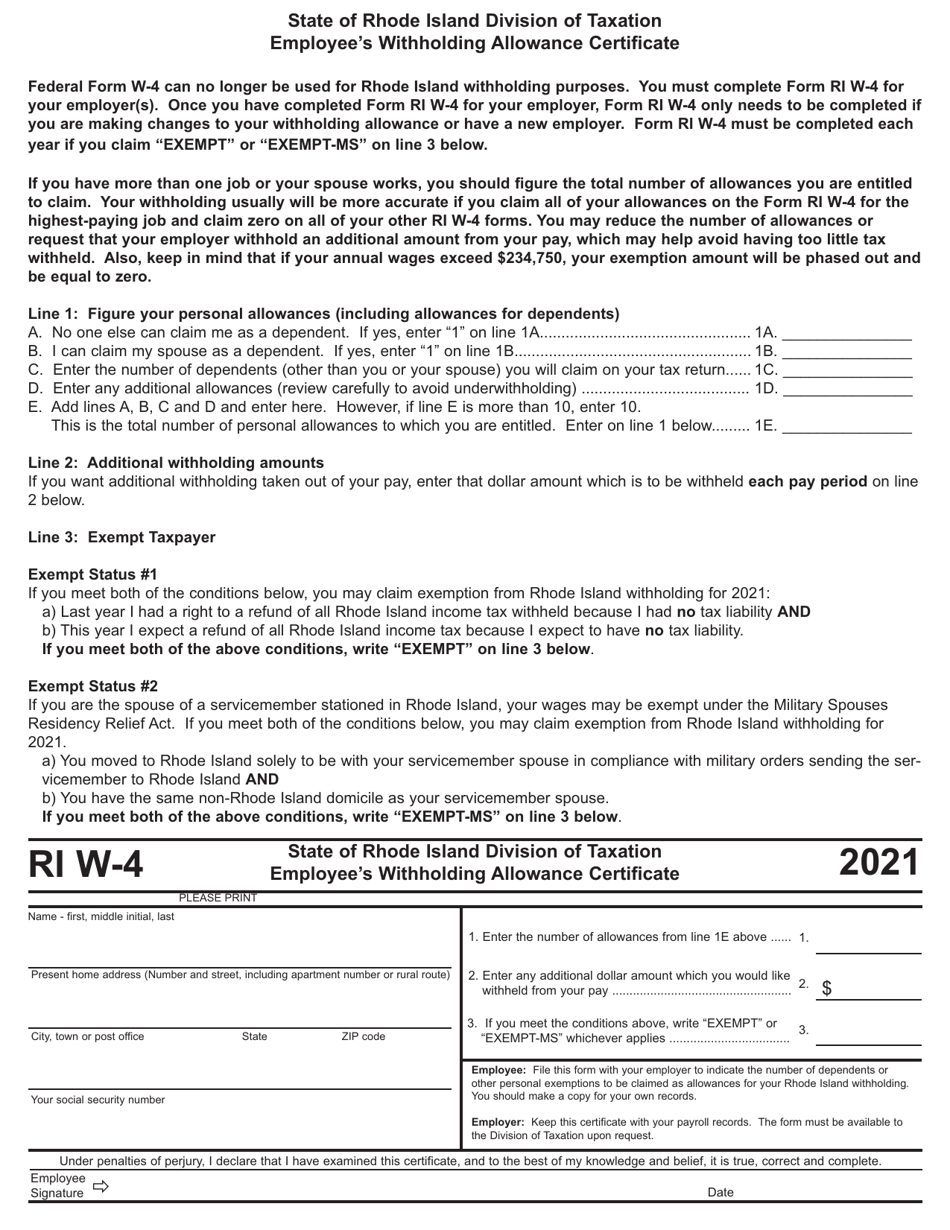

Form Ri W 4 Download Printable Pdf Or Fill Online Employee S Withholding Allowance Certificate 2021 Rhode Island Templateroller

State Conformity To Cares Act American Rescue Plan Tax Foundation

How Taxes On Property Owned In Another State Work For 2022

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Tax Return Deadlines In Ma Ri Me Nh Vt Ct In 2022

Homeowner Assistance Fund Ri Rihousing

Tops 1096 Tax Form Top2202 Officesupply Com

17 States With Estate Taxes Or Inheritance Taxes

Fill Free Fillable State Of Rhode Island Pdf Forms

Tax Assessor City Of Pawtucket

State Income Tax Rates And Brackets 2021 Tax Foundation

New State Rental Assistance Town Of Barrington Ri Facebook

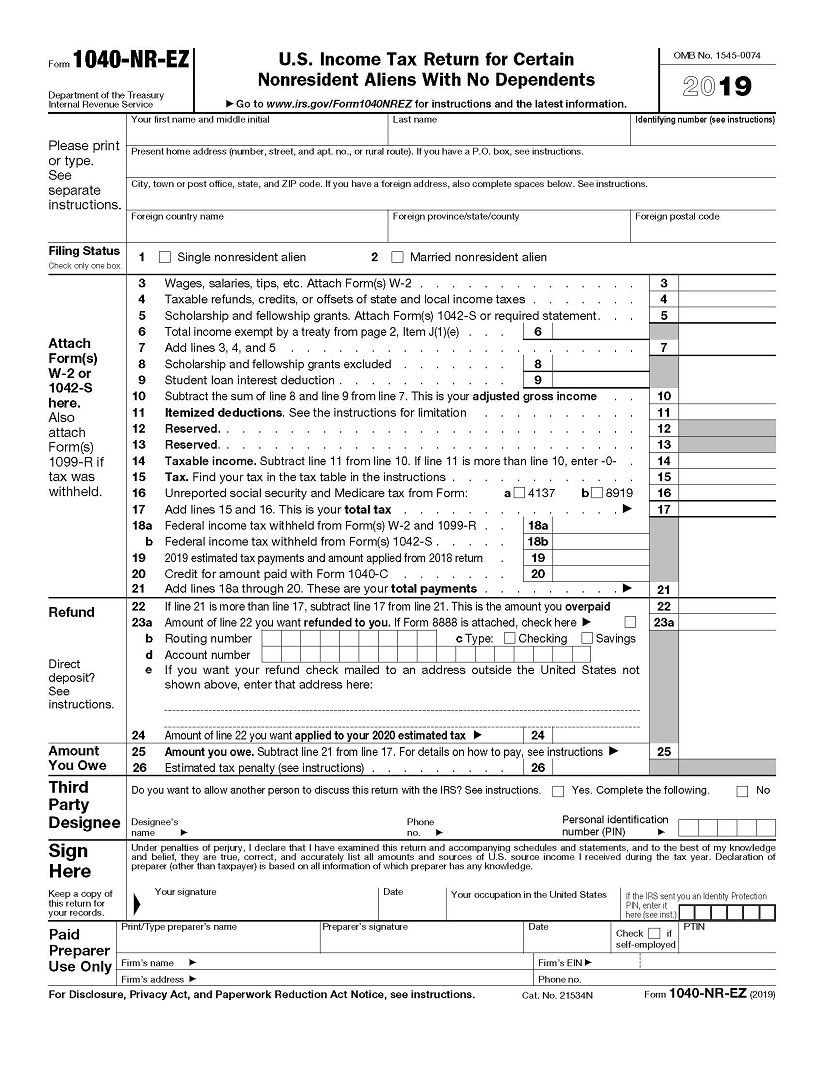

The Complete J1 Student Guide To Tax In The Us

Rhode Island State Bird Rhode Island Red Hen 50states Com 50states